New Global Wellness Institute research reveals a wellness market on fire: growing 35% since 2019 (6.2% annually) and forecast to expand even faster (7.6% yearly) through 2029. The explosive growth leaders: wellness real estate and mental wellness. The spend on wellness is now 60% as much as all health/medical expenditures

The Global Wellness Institute (GWI) this week released the Global Wellness Economy Monitor 2025, the only research that provides in-depth data and insights on the global wellness market and each of its 11 sectors.

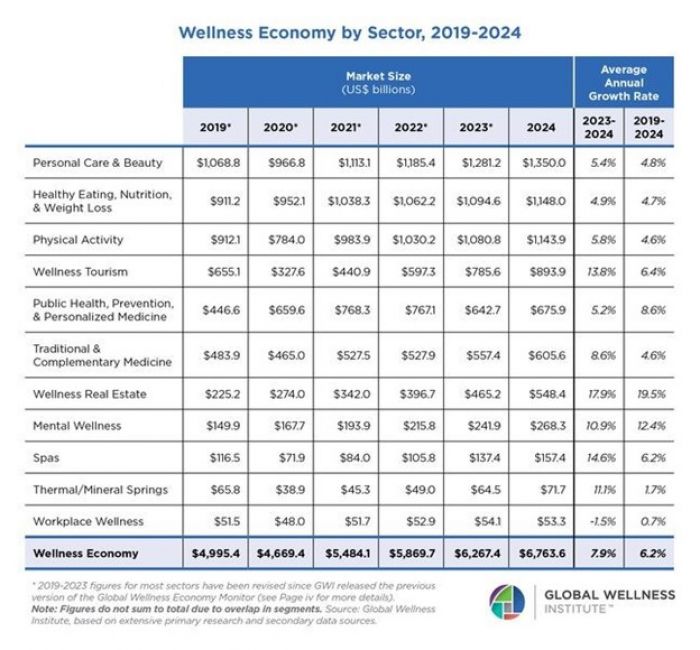

The story emerged from the data: The wellness market has doubled since 2013, and grew 7.9% from 2023 to 2024, reaching a new peak of $6.8 trillion, showing that the wellness market is officially beyond the pandemic recovery mode. By far the fastest growing segments are wellness estate and mental wellness, expanding at 19.5% and 12.4% annually, respectively, from 2019 to 2024. The only stagnant market: workplace wellness, with global spending shrinking by 1.5% from 2023 to 2024. Every regional wellness market has experienced major growth over the last five years, with North America (7.9%), Middle East-North Africa (7.2%) and Europe (6.3%) posting the biggest annual gains.

According to the research, there are obvious and more subtle reasons for this growth — an aging population, chronic disease and because of these reasons and others, anxiety, depression and mental unwellness— but also, a market newly focused on prevention and longevity. GWI predicts this industry will grow at an even faster pace (7.6% annually) through 2029, when it will approach $10 trillion. The predicted biggest gainers through 2029 by annual growth rate are wellness real estate (15.8%), traditional & complementary medicine (10.8%), mental wellness (10.1%) and thermal/mineral springs (10%).

“Now that the wellness economy has fully recovered from the pandemic, we can see how unstoppable it is as a consumer trend, and also how much the future growth has been accelerated by our pandemic experiences,” said Katherine Johnston, GWI senior research fellow.

“There’s been a sea change in consumer mindsets,” Ms. Johnson adds, “with prevention, mental health, social connection, the impacts of our living environments, and nature becoming dramatically more important all over the world. These shifts are fueling growth across all wellness sectors, from wellness real estate and mental wellness to hot springs and social bathing to more sophisticated preventative medical-wellness solutions.”

The fastest-growing market over the last five years is wellness real estate (19.5% annually), as the pandemic ignited a new awareness about the extraordinary impact that external environments have on our physical and mental health. The #2 growth star: mental wellness (12.4% annually), as people face increasingly immense stresses, and because for younger generations, mental wellbeing is non-negotiable. The US mental wellness market ($125 billion) dwarfs all other countries, with China a distant second at $16 billion. Mental wellness segments with powerful annual growth these last five years were cannabis products (26%), meditation and mindfulness (18.9%), and sleep (12.6%).

Four markets fall into the “mature and steady growth sectors”: personal care and beauty; healthy eating, nutrition and weight loss; physical activity; and traditional and complementary medicine, all of which experienced strong (roughly 5%) annual growth from 2019 to 2024. The tourism-based wellness sectors were hit hard by the pandemic but roared back between 2023 and 2024: wellness tourism grew 13.8%, spas 14.6%, and thermal/mineral springs 11.1%, making them three of the four largest year-over-year gainers, along with wellness real estate. Workplace wellness stands out for its lack of growth, as more employers move away from programmatic approaches to employee wellness and the surge in remote and “gig” work leaves more employees without access to such benefits.

Per capita spending on wellness is dramatically higher in North America ($6,029) and Europe ($1,876) compared to other regions like Latin America-Caribbean ($607), Asia ($471) and the Middle East-North Africa ($339).

Wellness real estate will remain the #1 growth leader (15.2% annual growth), doubling in size in the next five years, just as it did in the last five. Notable: traditional and complementary medicine is projected as the #2 future gainer (10.8% annually), not only because Ayurveda, TCM and herbal medicines are getting infused in ever more supplements/products, but because the category includes the spawning longevity and biohacking approaches––from infrared light therapy to cryotherapy to IV drips––now ubiquitous in fitness/wellness centers, spas and resorts.

Both mental wellness (10.1%) and wellness tourism (9.1%) will see powerful annual growth. The thermal/mineral springs market will be a future standout (10% annual growth) as hundreds of springs-based destinations are in the global investment pipeline and social bathhouses and water-based destinations are a huge global trend. Also to watch: within the “public health, prevention and personalized medicine” segment, the now $147 billion personalized medicine market is expected to see a rapid 9.3% yearly growth through 2029, as longevity-seeking consumers rush to diagnostic services and personalized health optimization.

By 2029, six wellness sectors—personal care & beauty; healthy eating, nutrition, & weight loss; physical activity; wellness tourism; wellness real estate; and traditional & complementary medicine—will exceed $1 trillion in market size, it is predicted.

The Global Wellness Institute (GWI), a nonprofit 501(c)(3), is considered the leading global research and educational resource for the global wellness industry and is known for introducing major industry initiatives and regional events that bring together leaders to chart the future.

www.globalwellnessinstitute.org.