Imagine being able to charge anything you want to your credit card—from a mega yacht to a McLaren to your kid’s Ivy League college tuition— without the worry of limits. One company has made this elevated shopping experience a reality. Called Plastiq, this unique service allows you to pay for things with your credit or debit card that you normally couldn't, things like real estate and country club dues. The possibilities are limitless. What’s more, since there is no participation necessary for the business or vendor you’re purchasing from, you can seemingly use Plastiq anywhere.

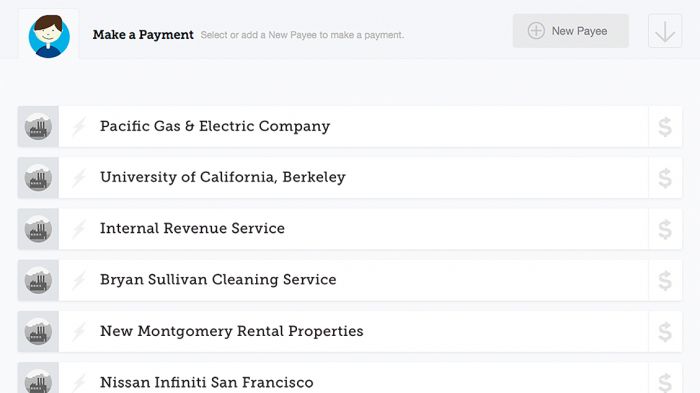

After you create an account with Plastiq, all you have to do is choose which credit or debit card you want to use for payment. Select the recipient, put in the needed information (like the name, address and phone number) and the service will transmit your payment in whatever form acceptable, which is usually a check or electronic transfer. Set up similar to that of a bank app, you can schedule payments, set up recurring payments, and track real-time status updates on transactions.

When it comes to keeping your personal and financial information safe, Plastiq promises that they leave nothing to chance. The company reports that all data is encrypted using 256-bit Extended Validation (EV) Secure Socket Layer (SSL) encryption technology. Multiple authentication procedures for identity verification are used to prevent fraud and identity theft during both account registration and payment processing. They are compliant with the Payment Card Industry Data Security Standard (PCI DSS) use Trustwave to ensure that their system is secure.

One of the service’s neatest (and most useful) features is that since it uses your own credit cards, you reap the same rewards as you would on a traditional transaction—except the stakes are much higher. The potential for racking up rewards points is practically endless. Consider how many points you’ll be able to accrue on largescale payments, like those to the IRS, home renovation projects, or yacht dealers.

Of course, Plastiq doesn’t exactly come free, as the service charges a 2.5 percent service fee per transaction. However, when you consider the potential for your rewards points to skyrocket—not to mention the convenience—that is a relatively small price to pay.